Rupee Cost Averaging Explained Simply: Your Investment Safety Net

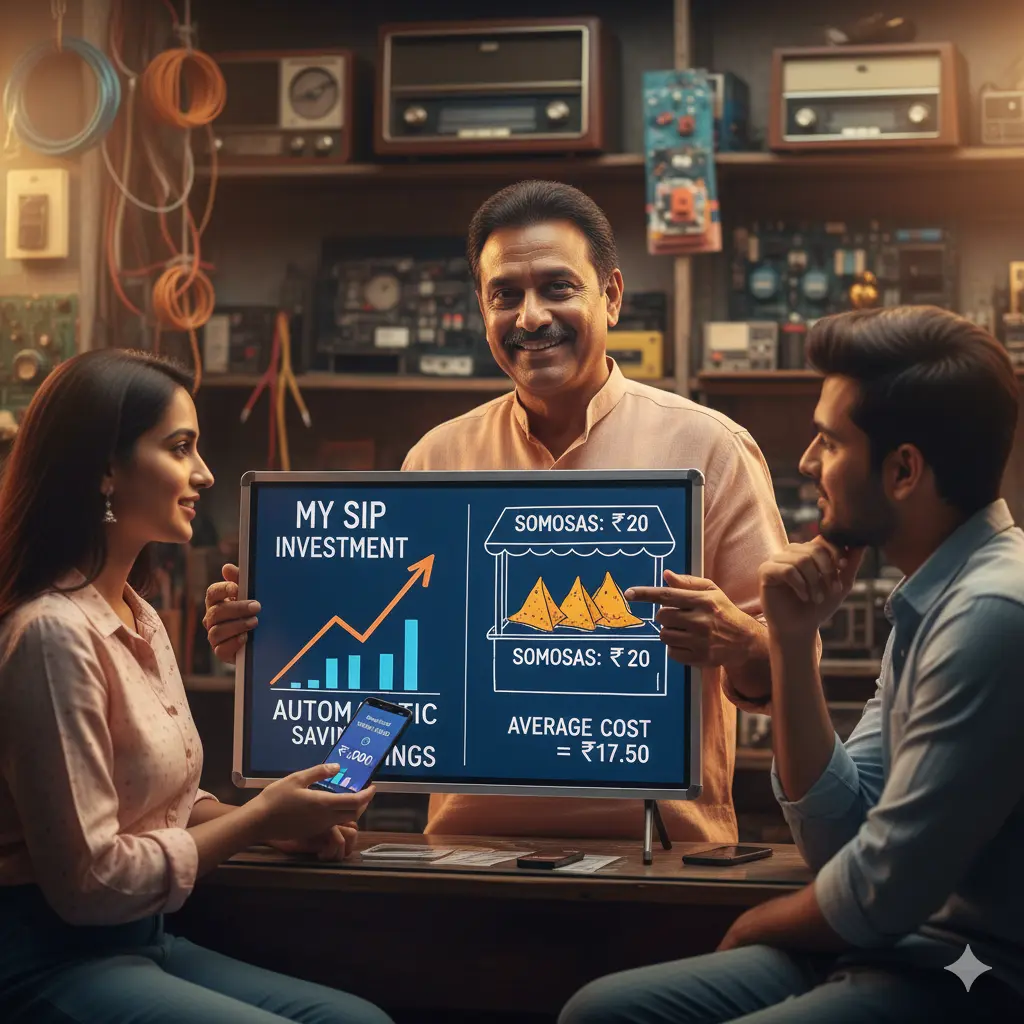

You know how you buy samosas from your local vendor? Some days they’re ₹15 each, some days ₹20 during festive season. But you keep buying because—well, samosas! Over months, your average cost evens out. That’s exactly what rupee cost averaging does with your mutual fund investments.

Imagine investing ₹5,000 every month through SIP, sometimes buying at ₹50 per unit, sometimes at ₹30 when markets dip. Over time, your average cost becomes ₹40—that’s rupee cost averaging working its magic! This simple strategy has helped millions of Indian investors build wealth without the headache of timing markets perfectly.

What is Rupee Cost Averaging for Beginners?

Here’s the thing about what is rupee cost averaging for beginners—it’s basically your financial autopilot. Most people think they need a crystal ball to predict market highs and lows. Spoiler alert: you don’t.

Rupee cost averaging means investing a fixed amount regularly, regardless of whether the market’s celebrating Diwali or crying during monsoon floods. When mutual fund prices fall, your monthly SIP buys more units. When prices rise, you buy fewer units. This automatically averages your purchase cost over time—genius, right?

Real Success Story from My Neighbourhood: Ravi bhai runs a small electronics shop in Pune. He started a ₹3,000 SIP back in 2020 (yes, during COVID chaos). Everyone told him, “Pagal hai? Market gir raha hai!” But he kept investing. Today, his ₹1.08 lakh investment has grown to ₹1.85 lakh. The secret? Rupee cost averaging bought him more units when everyone was panicking.

Before Rupee Cost Averaging: Build Your Emergency Fund

Rupee cost averaging is a powerful investment strategy. But like all wealth-building strategies, it works best when you have financial security first.

Why emergency fund matters for RCA investing:

When you practice rupee cost averaging – investing the same amount monthly – you’re making a long-term commitment. If an emergency strikes and you don’t have emergency savings, you’ll break this commitment.

- You’ll have to stop your RCA midway

- You might have to redeem investments at losses

- The power of averaging gets broken

Calculate your emergency fund first using our free tool:

💰 Calculate Your Emergency Fund →

The right sequence:

- Build emergency fund (3-6 months expenses)

- Start rupee cost averaging with remaining funds

- Continue both simultaneously – EF stays safe, RCA keeps growing

- After 20 years, you’ll have both security AND wealth

Emergency fund is your financial safety net. Rupee cost averaging is your wealth builder. You need both working together!

How Does Rupee Cost Averaging Work? (Step-by-Step Like Making Perfect Chai)

Think of how does rupee cost averaging work like brewing the perfect cup of chai:

You Add Fixed Sugar (Your Monthly Investment): Always ₹2,000, ₹5,000, or whatever amount you choose

Milk Price Changes (Market Goes Up/Down): Sometimes expensive, sometimes cheap

You Keep Making Chai (Continue SIP): Good days, bad days—doesn’t matter

Perfect Average Taste (Lower Average Cost): Your long-term cost evens out beautifully

Mathematical Formula (Don’t worry, it’s simple):

Average Cost = Total Investment ÷ Total Units Purchased

The beauty? You don’t need to calculate anything—your SIP does it automatically!

Rupee Cost Averaging SIP Example India (Real Mumbai Street Prices)

Let me show you rupee cost averaging SIP example India with actual numbers. Imagine you’re investing ₹5,000 monthly like buying vegetables at Crawford Market—some months tomatoes are expensive, some months they’re practically free:

| Month | Your Investment | NAV (₹) | Units You Buy | Total Units Collected |

|---|---|---|---|---|

| Jan | ₹5,000 | 50 | 100.00 | 100.00 |

| Feb | ₹5,000 | 40 | 125.00 | 225.00 |

| Mar | ₹5,000 | 60 | 83.33 | 308.33 |

| Apr | ₹5,000 | 35 | 142.86 | 451.19 |

| May | ₹5,000 | 45 | 111.11 | 562.30 |

| Jun | ₹5,000 | 55 | 90.91 | 653.21 |

Your Numbers:

Total Investment: ₹30,000

Average Cost per Unit: ₹45.93

Market’s Average NAV: ₹47.50

Your Savings: ₹1,025 (without doing anything smart—just being consistent!)

This is rupee cost averaging calculation example at its finest—you saved money while everyone else stressed about market timing.

Rupee Cost Averaging vs Dollar Cost Averaging (India vs America)

People often ask about rupee cost averaging vs dollar cost averaging—honestly, it’s like comparing chai and coffee. Both wake you up, just different flavors!

| Factor | Rupee Cost Averaging (Our Desi Version) | Dollar Cost Averaging (American Style) |

|---|---|---|

| Currency | Indian Rupees (₹) | US Dollars ($) |

| Where | NSE, BSE mutual funds | NYSE, NASDAQ |

| Start Amount | ₹500/month | $25/month |

| Tax Perks | ELSS saves tax under 80C | 401(k) tax benefits |

| Market Hours | 9:15 AM–3:30 PM (IST) | 9:30 AM–4:00 PM (EST) |

Same strategy, different playground. Whether you’re in Connaught Place or Wall Street, the math works identically.

Rupee Cost Averaging Benefits for SIP Investors (Why Your Grandmother Would Approve)

1. No More “Perfect Timing” Headaches

My aunt always says, “Beta, perfect time kabhi nahi aata.” She’s right about investments too. Rupee cost averaging benefits include eliminating the need to predict market bottoms or tops. Just invest regularly—like paying your monthly phone bill.

2. Automatic Bargain Hunting

During 2020 market crash, while everyone panicked, SIP investors were like smart shoppers at end-of-season sales—buying more units when prices crashed. Rupee cost averaging in SIP turns market volatility into your friend.

3. Emotional Discipline (No More FOMO)

Ever bought stocks because your WhatsApp group was celebrating some “hot tip”? Rupee cost averaging prevents such emotional mistakes. You invest the same amount whether markets are partying or crying.

4. Mathematical Advantage Over Lump Sum

How rupee cost averaging works mathematically: it typically provides lower average costs compared to one-time big investments. Think bulk buying dal—better prices when you spread purchases over time.

5. Beginner-Friendly (Even Your College-Going Cousin Can Start)

No MBA required. Start what is rupee cost averaging for beginners with just ₹500 monthly. That’s less than your weekend movies and popcorn!

Best Mutual Funds for Rupee Cost Averaging (Personal Recommendations)

Based on my research and what’s working for people I know:

Large Cap Funds (Safe Like Fixed Deposits, But Better)

ICICI Prudential Bluechip Fund

Axis Bluechip Fund

SBI Bluechip Fund

Mid Cap Funds (Little Spicy, Good Returns)

HDFC Mid-Cap Opportunities Fund

Axis Midcap Fund

Invesco India Mid Cap Fund

Index Funds (Set It, Forget It)

UTI Nifty Index Fund (0.1% expense ratio—cheapest!)

ICICI Prudential Nifty Index Fund

Common Rupee Cost Averaging Mistakes (Learn From Others’ Oops Moments)

1. Stopping SIP During Market Falls

My friend Rahul stopped his SIP during COVID crash. Big mistake! That’s when rupee cost averaging works best—buying cheap units. Don’t be like Rahul.

2. Increasing Investment During Market Highs

Saw your portfolio value jump? Resist the urge to suddenly double your SIP. Stick to planned amounts—that’s how rupee cost averaging calculation stays effective.

3. Short-term Expectations

Rupee cost averaging explained simply works over years, not months. Like growing a mango tree—patience required.

4. Choosing Wrong Funds

Don’t pick funds based on last year’s returns. Check 5-year track records, expense ratios, and fund manager consistency.

Step-by-Step Guide: How to Start Rupee Cost Averaging Today

Step 1: Choose your monthly amount (₹1,000, ₹3,000, ₹5,000—whatever doesn’t disturb your chai-samosa budget)

Step 2: Pick 2-3 good mutual funds (mix of large-cap and index funds for beginners)

Step 3: Set up SIP through Groww, Zerodha, or your bank’s app

Step 4: Automate it—let it run like your monthly Netflix subscription

Step 5: Review annually (not daily!)

When Does Rupee Cost Averaging Not Work? (Honest Talk)

Look, rupee cost averaging isn’t magic. It won’t work if:

You pick terrible funds (research matters!)

You stop during tough times (defeats the whole purpose)

You expect quick results (patience, grasshopper)

You keep changing funds every few months

Real Results: Rupee Cost Averaging During Major Market Events

2008 Global Crisis: SIP investors who continued got fantastic returns by 2012

2016 Demonetization: Temporary dip, then strong recovery for persistent investors

2020 COVID Crash: Best rupee cost averaging example—investors who stayed course saw 40-50% returns by 2022

The pattern? Markets recover, patient investors win.

Tax Implications of Rupee Cost Averaging (The Boring But Important Stuff)

ELSS Funds: Get tax deduction up to ₹1.5 lakh under Section 80C

Long-term Gains: Hold for 1+ years, pay 10% tax only on gains above ₹1 lakh

Short-term Gains: Less than 1 year = 15% tax

Pro Tip: Use rupee cost averaging with ELSS funds for double benefit—wealth building plus tax savings!

FAQs About Rupee Cost Averaging

What is rupee cost averaging explained simply?

Rupee cost averaging means investing a fixed amount every month in mutual funds. When prices are low, you buy more units; when prices are high, you buy fewer units. Over time, this evens out your average purchase cost—much like buying groceries throughout the month instead of in one big bulk purchase.How does rupee cost averaging work in SIP?

SIP (Systematic Investment Plan) automates rupee cost averaging. Your monthly investment buys more mutual fund units when the NAV is low and fewer when the NAV is high, reducing your average cost per unit over time without extra effort.Is rupee cost averaging better than lump sum investment?

In volatile markets, yes. Rupee cost averaging reduces the risk of buying at market peaks and often results in a lower average purchase price compared to investing a single lump sum.What is the difference between rupee cost averaging and dollar cost averaging?

Both strategies are the same—making regular fixed investments. Rupee cost averaging uses Indian rupees in Indian mutual funds, while dollar cost averaging uses US dollars in US markets. The principle remains identical.Can I use rupee cost averaging for stocks?

Yes, but it works best with mutual funds because they are diversified. Investing in individual stocks monthly can incur higher brokerage fees and requires more research.What happens to rupee cost averaging during market crashes?

Market crashes are actually ideal for rupee cost averaging. Your fixed monthly investment buys more units when prices are low, enabling you to benefit from discounted rates when the market recovers.

Internal Links (Building Our Finance Knowledge Web)

SIP Calculator for Beginners India – Calculate your SIP returns

Emergency Fund Calculator for Young Indians – Build your safety net first

How to Choose Your First Mutual Fund – Pick the right funds

External References (Trust But Verify)

SEBI Investor Education – Official regulatory guidance

AMFI Data – Mutual fund industry data

RBI Financial Education – Central bank resources

Call-to-Action & Personal Note

Ready to Start Your Rupee Cost Averaging Journey?

I’ve seen too many friends miss out on wealth creation because they were waiting for the “perfect time” to invest. Spoiler alert: there isn’t one. But there’s something better—rupee cost averaging through SIP.

Start small, stay consistent, and let math do the heavy lifting. Your future self will thank you during your morning chai, trust me.

Questions? Drop them in comments below—I read and reply to every single one. Let’s build wealth together, one SIP at a time!

Absolutely written subject matter, appreciate it for information .