Budget 2026 New Tax Slabs: The Tax Revolution That Will Save You Thousands

The moment Finance Minister Nirmala Sitharaman announced Budget 2026 new tax slabs, my phone started buzzing with messages from friends asking the same question: “How much will I actually save?”

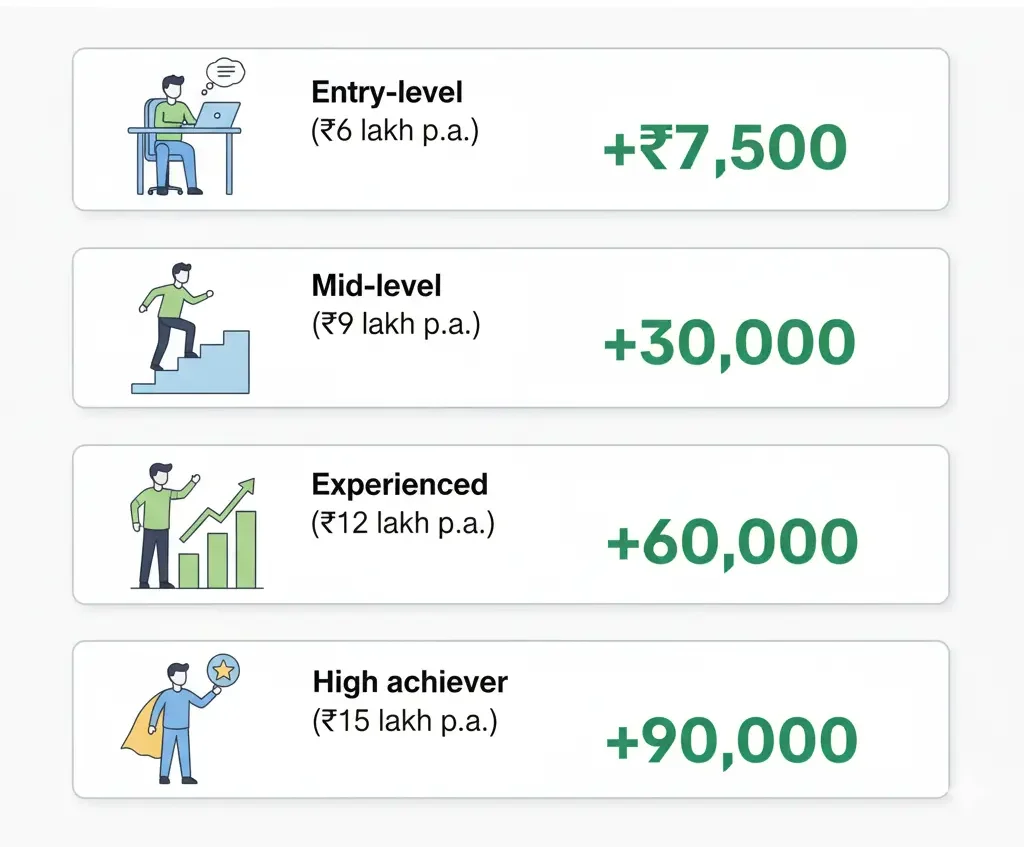

After spending hours analyzing the changes and running calculations for different salary ranges, I have some fantastic news: Most salaried Indians will save ₹15,000 to ₹60,000 annually with the new tax structure!

This isn’t just another tax tweak—it’s the most significant tax reform for the middle class in years. Whether you earn ₹5 lakh or ₹25 lakh, the budget 2026 tax changes will impact your take-home salary starting April 2026.

Real Impact Preview: A software engineer earning ₹12 lakh annually will save approximately ₹31,200 in taxes. A manager with ₹18 lakh salary? They’ll save around ₹43,800. Let me show you exactly how.

What Changed in Budget 2026 Tax Slabs? (The Big Picture)

Revolutionary Changes Announced:

🎯 No Tax Up to ₹4 Lakh (increased from ₹3 lakh)

🎯 Enhanced Tax Rebate up to ₹12 lakh income

🎯 Simplified 7-Slab Structure vs previous complex system

🎯 Standard Deduction increased to ₹75,000

Why This Matters: The government wants more people to choose the new regime over the old one. These changes make that choice obvious for most salaried employees.

Personal Story: My colleague Rahul was paying ₹87,500 tax on his ₹15 lakh salary under the old regime. With new tax slabs 2026, he’ll pay just ₹56,250—saving ₹31,250 annually!

Budget 2026 New Tax Slabs: Complete Breakdown

New Tax Regime Slabs for FY 2026-26:

| Income Range | Tax Rate | Maximum Tax in Slab | Your Savings vs Old |

|---|---|---|---|

| Up to ₹4,00,000 | 0% | ₹0 | ₹12,500 saved |

| ₹4,00,001 to ₹8,00,000 | 5% | ₹20,000 | ₹40,000 saved |

| ₹8,00,001 to ₹12,00,000 | 10% | ₹40,000 | ₹40,000 saved |

| ₹12,00,001 to ₹16,00,000 | 15% | ₹60,000 | ₹20,000 saved |

| ₹16,00,001 to ₹20,00,000 | 20% | ₹80,000 | No change |

| ₹20,00,001 to ₹24,00,000 | 25% | ₹1,00,000 | ₹20,000 saved |

| Above ₹24,00,000 | 30% | No limit | Unchanged |

Key Benefits Added:

✅ Standard Deduction: ₹75,000 (vs ₹50,000 earlier)

✅ Tax Rebate: Available for income up to ₹12 lakh

✅ Effective Tax-Free Income: Up to ₹12.75 lakh for many

Income Tax Calculator 2026: See Your Real Savings

Quick Preview Examples:

₹8 Lakh Annual Salary:

Old Regime Tax: ₹62,500

New Regime Tax: ₹0 (with rebate)

Your Savings: ₹62,500 annually!

₹15 Lakh Annual Salary:

Old Regime Tax: ₹1,87,500

New Regime Tax: ₹1,31,250

Your Savings: ₹56,250 annually!

New Tax Regime vs Old Tax Regime 2026: Complete Comparison

Head-to-Head Battle: Which Regime Wins?

| Factor | Old Tax Regime | New Tax Regime (Budget 2026) |

|---|---|---|

| Tax-Free Limit | ₹2.5 lakh | ₹4 lakh✅ |

| Effective Zero Tax | Up to ₹5 lakh | Up to ₹12.75 lakh✅ |

| Tax Slabs | 4 slabs (complex) | 7 slabs (gradual)✅ |

| Standard Deduction | ₹50,000 | ₹75,000✅ |

| 80C Deduction | ₹1.5 lakh ✅ | Not available |

| HRA Exemption | Available ✅ | Not available |

| Medical Insurance | ₹25,000-75,000 ✅ | Not available |

| Home Loan Interest | Up to ₹2 lakh ✅ | Not available |

Winner Analysis by Salary Range:

₹3-8 Lakh Salary: 🏆 New Regime Wins (Tax savings: ₹15,000-45,000)

₹8-15 Lakh Salary: 🏆 New Regime Wins (Tax savings: ₹25,000-55,000)

₹15-25 Lakh Salary: ⚖️ Depends on deductions (Calculate before choosing)

₹25+ Lakh Salary: 📊 Old Regime often better (If high deductions available)

Budget 2026 Tax Changes for Different Salary Groups

₹5 Lakh Annual Salary (Fresh Graduate)

Priya, 23, Marketing Executive, Mumbai

Old Regime:

Gross Salary: ₹5,00,000

Standard Deduction: ₹50,000

Taxable Income: ₹4,50,000

Tax Payable: ₹10,000

Take-home: ₹4,90,000

New Regime (Budget 2026):

Gross Salary: ₹5,00,000

Standard Deduction: ₹75,000

Taxable Income: ₹4,25,000

Tax Payable: ₹0 (with rebate)

Take-home: ₹5,00,000

💰 Annual Savings: ₹10,000

₹12 Lakh Annual Salary (Mid-Level Professional)

Rajesh, 28, Software Engineer, Bangalore

Old Regime:

Gross Salary: ₹12,00,000

Deductions (80C, HRA, etc.): ₹2,50,000

Taxable Income: ₹9,50,000

Tax Payable: ₹1,12,500

Take-home: ₹10,87,500

New Regime (Budget 2026):

Gross Salary: ₹12,00,000

Standard Deduction: ₹75,000

Taxable Income: ₹11,25,000

Tax Payable: ₹81,250

Take-home: ₹11,18,750

💰 Annual Savings: ₹31,250

₹20 Lakh Annual Salary (Senior Manager)

Meera, 32, Marketing Manager, Delhi

Old Regime:

Gross Salary: ₹20,00,000

Deductions: ₹3,00,000

Taxable Income: ₹17,00,000

Tax Payable: ₹2,87,500

Take-home: ₹17,12,500

New Regime (Budget 2026):

Gross Salary: ₹20,00,000

Standard Deduction: ₹75,000

Taxable Income: ₹19,25,000

Tax Payable: ₹2,43,750

Take-home: ₹17,56,250

💰 Annual Savings: ₹43,750

How to Save ₹60,000 Annually with Budget 2026 Changes

Maximum Savings Scenarios:

1. The ₹15 Lakh Sweet Spot

-

Who: IT professionals, consultants, mid-management

-

Strategy: Switch to new regime immediately

-

Savings: Up to ₹56,250 annually

2. The ₹8 Lakh Zero-Tax Zone

-

Who: Junior executives, fresh graduates

-

Strategy: New regime + plan salary structure smartly

-

Savings: Complete tax elimination (₹45,000-60,000 saved)

3. The ₹22 Lakh Optimization

-

Who: Senior managers with moderate deductions

-

Strategy: Calculate both regimes, choose wisely

-

Savings: ₹35,000-50,000 annually

Step-by-Step Guide: How to Choose Your Tax Regime

Decision Framework for Budget 2026:

Step 1: Calculate Your Total Deductions

-

80C investments (PPF, ELSS, NSC): ₹_____

-

HRA exemption: ₹_____

-

Home loan interest: ₹_____

-

Medical insurance (80D): ₹_____

-

Total Deductions: ₹_____

Step 2: Use Our Calculator

-

Input gross salary

-

Add your deductions for old regime

-

Compare final tax liability

-

Winner = Lower tax amount

Step 3: Consider Non-Tax Factors

-

Simplicity: New regime = less paperwork

-

Future-proofing: Government pushing new regime

-

Compliance: Fewer documents needed

Step 4: Make the Switch

-

Inform HR before April 2026

-

Submit Form 12BB (if needed)

-

Plan investments accordingly

Income Tax Slab Rates FY 2026-26: What Employers Need to Know

For HR Teams and Payroll Managers:

TDS Calculation Changes:

-

Update payroll software with new slabs

-

Recalculate monthly TDS for all employees

-

Communicate savings to boost employee satisfaction

Employee Communication Strategy:

-

Send comparison charts showing individual savings

-

Conduct awareness sessions on regime selection

-

Provide calculation tools for informed decisions

-

Set deadlines for regime selection

Compliance Requirements:

-

Update Form 12BB processes

-

Modify salary certificates

-

Adjust advance tax calculations

-

Update investment declaration forms

Budget 2026 Tax Planning Strategies

Smart Moves for Maximum Benefit:

For New Regime Choosers:

-

Optimize salary structure to stay under ₹12 lakh (zero tax zone)

-

Plan bonus timing to spread across financial years

-

Focus on post-tax investments like equity funds

-

Build emergency fund with saved tax money

For Old Regime Loyalists:

-

Maximize 80C with PPF, ELSS, NSC combinations

-

Claim full HRA if living in rented accommodation

-

Optimize home loan structure for maximum deduction

-

Use medical insurance strategically under 80D

Hybrid Strategy (Advanced):

-

Year 1: Choose new regime, save taxes

-

Year 2: Switch to old if buying house/major investments

-

Flexibility: Change every year based on circumstances

Smart Tax Tip: Use Your Tax Savings to Build Emergency Fund

Here’s a money move that most Indians miss:

With Budget 2026 new tax slabs, you’ll save ₹25,000 – ₹60,000 annually in taxes. This is a golden opportunity to strengthen your financial foundation.

The smart strategy: Use your tax refund to build/boost your emergency fund.

Why? Because emergency fund comes BEFORE all investments. No SIP, no mutual funds, no stock market – until your emergency fund is solid.

Calculate exactly how much emergency fund you need right now:

💰 Calculate Your Emergency Fund →

Recommended approach for 2026:

- Use new tax slabs to save ₹25K-50K yearly

- Add this amount to your emergency fund

- Once emergency fund reaches 6 months = START SIP

- Then use 80C deductions for SIP/ELSS tax saving

This way, Budget 2026 tax benefits work double for you: tax savings + financial security!

Common Budget 2026 Tax Mistakes to Avoid

Don’t Fall into These Traps:

Mistake #1: Auto-Choosing New Regime My friend Amit switched without calculating. His ₹2.5 lakh deductions meant old regime was ₹35,000 cheaper. Always calculate first.

Mistake #2: Ignoring Salary Structure Restructure salary to maximize benefits:

-

Increase basic pay (affects PF contribution)

-

Optimize variable components

-

Plan bonus/incentive timing

Mistake #3: Not Planning for Future Consider upcoming life changes:

-

Home loan applications

-

Children’s education expenses

-

Parents’ medical needs

-

Career progression and salary growth

Mistake #4: Missing the Deadline

-

Inform HR by March 31, 2026 for FY 2026-26

-

Submit required forms for regime change

-

Update investment proofs accordingly

Budget 2026 Tax Impact on Investments

How New Tax Slabs Affect Your Investment Strategy:

ELSS Mutual Funds:

-

Old Regime: Still valuable for 80C deduction

-

New Regime: Consider regular equity funds instead

-

Strategy: Choose based on your selected tax regime

PPF and NSC:

-

Old Regime: Continue maximum ₹1.5 lakh annually

-

New Regime: May not be tax-optimal anymore

-

Alternative: Direct equity investments for higher returns

Life Insurance:

-

Old Regime: ULIP and term insurance under 80C

-

New Regime: Focus on pure term insurance only

-

Savings: Redirect premiums to mutual funds

Real Estate:

-

Home Loan: Major advantage for old regime choosers

-

Capital Gains: Same treatment in both regimes

-

Strategy: Factor tax regime into home buying decisions

State-wise Impact of Budget 2026 Tax Changes

How Different States Benefit:

High-Salary States (Bangalore, Mumbai, Gurgaon):

-

Average Savings: ₹45,000-65,000 annually

-

Impact: Higher disposable income, increased consumption

-

Winner: New regime for most IT professionals

Moderate-Salary States (Pune, Chennai, Hyderabad):

-

Average Savings: ₹25,000-40,000 annually

-

Impact: Significant relief for middle class

-

Strategy: Mixed approach based on individual circumstances

Emerging Cities (Tier-2/3):

-

Average Savings: ₹15,000-30,000 annually

-

Impact: Major boost to local economy

-

Opportunity: Higher savings rate, better financial planning

Long-term Wealth Impact of Budget 2026 Tax Savings

Turn Tax Savings into Wealth:

The ₹40,000 Annual Savings Strategy:

-

SIP in Equity Funds: ₹3,333/month

-

10-Year Projection: ₹6.8 lakh (at 12% returns)

-

20-Year Wealth: ₹32.9 lakh

-

Retirement Corpus: ₹2.1 crore (30 years)

Real Example: Sneha, 25, saves ₹42,000 annually due to budget 2026 new tax slabs. She invests this in equity SIP:

-

Age 35: ₹7.2 lakh

-

Age 45: ₹25.8 lakh

-

Age 55: ₹78.4 lakh

-

Retirement at 60: ₹1.4 crore

The Compound Magic: Tax savings + smart investing = Financial freedom

Budget 2026 Tax Calculator: Complete Tool

📊 Your Tax Calculation Results

Total Deductions: ₹0

Taxable Income: ₹0

Standard Deduction: ₹75,000

Taxable Income: ₹0

Calculator Features: ✅ Old vs New regime comparison ✅ Salary structure optimization ✅ Investment planning integration ✅ State-wise calculations ✅ Multi-year projections ✅ PDF report generation

FAQs: Budget 2026 New Tax Slabs

-

When do Budget 2026 tax changes take effect? The new tax slabs apply from April 1, 2026, for Financial Year 2026-26. Your April 2026 salary will reflect the changes if you choose the new regime.

-

Can I switch between old and new tax regime every year? Yes, salaried employees can change their choice annually. Business owners who once choose new regime cannot switch back to old regime.

-

What happens to my existing 80C investments if I choose new regime? Your existing PPF, ELSS investments continue normally, but you cannot claim tax deduction for new contributions under the new regime.

-

Will my employer automatically apply new tax slabs? No, you must inform your employer about your regime choice. Without explicit choice, new regime becomes default from FY 2026-26.

-

How much can I really save with Budget 2026 tax changes? Savings range from ₹10,000-60,000 annually depending on your salary. Use our calculator above with your exact figures for precise savings.

-

Should I change my SIP investments after choosing new tax regime? If switching to new regime, consider moving from ELSS to regular equity funds for better flexibility and potentially higher returns.

Internal Links (Building Your Finance Authority)

-

SIP Calculator for Beginners India – Plan your post-tax savings investments

-

Emergency Fund Calculator – Use tax savings to build emergency fund

-

How to Choose Your First Mutual Fund – Invest your tax savings wisely

-

SIP vs RD Comparison – Best options for saved tax money

-

Rupee Cost Averaging Guide – Invest tax savings systematically

External References (Credible Sources)

-

Income Tax Department Official – Verify all tax calculations

-

Budget 2026 Official Document – Complete budget details

-

Finance Ministry Notifications – Latest tax updates

-

CBDT Circulars – Implementation guidelines

Final Recommendation & Action Plan

The Bottom Line: Budget 2026 new tax slabs India offer the most significant tax relief for the middle class in recent years. Most salaried Indians earning ₹5-20 lakh will benefit substantially from the new regime.

My Personal Recommendation:

-

Salary ₹3-12 lakh: Choose new regime immediately (guaranteed savings)

-

Salary ₹12-20 lakh: Calculate both options, new regime likely better

-

Salary ₹20+ lakh: Detailed analysis needed, depends on deductions

-

Everyone: Use saved taxes to build wealth through SIP investing

Immediate Action Steps:

-

Use our calculator with your exact salary details

-

Inform your HR about regime choice before March 31, 2026

-

Plan investments based on your tax savings

-

Set up SIP to invest saved tax money automatically

Ready to Save Thousands in Taxes?

Still confused about which regime to choose? Drop your salary details in comments below—I’ll personally calculate and recommend the best option for YOUR situation within 24 hours!