💰 Emergency Fund Calculator

Calculate exactly how much you need

Include rent, groceries, utilities, insurance, EMIs

6-9 months typical for young Indians

For 6 months of expenses with inflation adjustment

To reach goal in 5 years

| Your Monthly Expenses | ₹50,000 |

| Buffer Months Selected | 6 |

| Inflation Adjustment | +5% |

| City Cost Factor | Delhi (Base) |

If you’re a young Indian staring at your bank balance after an unexpected expense—and wondering ‘How do I calculate the right emergency fund?’—you’re not alone. Our emergency fund calculator helps you determine exactly how much you need”—you’re not alone. A recent survey found that 72% of young professionals search “emergency fund calculator India” online. Whether it’s a medical bill, job loss, or urgent home repair, having the right safety net can mean the difference between stability and debt. This guide will show you exactly how much you need—and how to build it—step by step.

The Reality Check: Why Young Indians Are on Financial Thin Ice

Gen Z (22–27): 59% admit they have no emergency savings

Millennials (28–42): 53% lack adequate emergency funds

47% of Indians save less than 10% of their income

Healthcare Costs Rising: Medical inflation at 14% annually

Job Market Volatility: Frequent layoffs in startups and tech

“Use Our Emergency Fund Calculator: Step-by-Step Guide for Young Indians”

Enter your monthly expenses (rent, groceries, utilities, EMIs).

Select your city (Delhi, Mumbai, Bangalore, Chennai, Hyderabad, Kolkata) for cost-of-living adjustments.

Choose your risk buffer (6, 9, or 12 months).

View your target emergency fund amount and monthly savings plan.

Quick Quiz: Which Emergency-Fund Phase Are You In?

Phase 1: ₹50,000 Foundation

Phase 2: 3-Month Buffer

Phase 3: Full Safety Net

Type your answer in the comments below to see personalized tips!

Emergency Fund Rules Indian Cities — How Much You Need

| City | Monthly Expenses (₹) | 6-Month Fund | 9-Month Fund | 12-Month Fund |

|---|---|---|---|---|

| Delhi | 40,000 | ₹2.4 lakh | ₹3.6 lakh | ₹4.8 lakh |

| Mumbai | 50,000 | ₹3.0 lakh | ₹4.5 lakh | ₹6.0 lakh |

| Bangalore | 45,000 | ₹2.7 lakh | ₹4.05 lakh | ₹5.4 lakh |

| Hyderabad | 38,000 | ₹2.28 lakh | ₹3.42 lakh | ₹4.56 lakh |

| Kolkata | 35,000 | ₹2.1 lakh | ₹3.15 lakh | ₹4.2 lakh |

| Chennai | 35,000 | ₹2.1 lakh | ₹3.15 lakh | ₹4.2 lakh |

This “emergency fund rules Indian cities” table tailors your savings to local living costs.

Emergency Fund by Age Group India — Tailored Buffers

22–25 years: 6 months of expenses (~₹2–4 lakh)

26–30 years: 9 months (~₹3–6 lakh)

31–35 years: 12 months (~₹4–8 lakh)

36–45 years: 12–18 months (~₹5–10 lakh)

Use “emergency fund by age group India” to customize your buffer.

Where to Keep Emergency Fund India — Best Options

High-Yield Savings Accounts (3–4% interest, instant access)

Liquid Mutual Funds (6–7% returns, same-day redemption)

Short-Term FDs (5–6%, check for no-penalty withdrawal)

“Where to keep emergency fund India” ensures you balance liquidity and returns.

Emergency Fund vs Investment — Striking the Right Balance

| Purpose | Emergency Fund | SIP Investment | Recommended Split |

|---|---|---|---|

| Liquidity | High | Low | 60% / 40% |

| Expected Returns | 3–6% | 10–14% | |

| Risk Level | Minimal | Moderate |

Before increasing equity SIPs, build your emergency fund first.

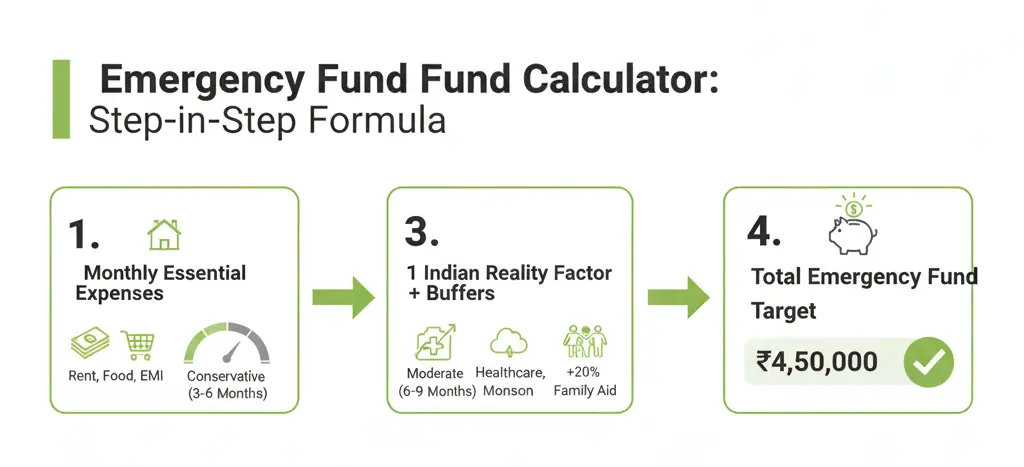

Emergency Fund Calculator Formula Explained

Calculate Your Monthly Essential Expenses

Include only absolute necessities:

Rent/EMI payments

Groceries and utilities

Transportation costs

Insurance premiums

Loan payments (credit cards, personal loans)

Basic healthcare costs

Minimum family support (if applicable)

(Tip: Use our downloadable checklist PDF to tick off each expense.)

Exclude: Entertainment, dining out, shopping, vacations, and lifestyle expenses.

Choose Your Risk Multiplier

Conservative Approach (3-6 months):

Stable job in government/large MNC

Dual-income household

Minimal health issues

Strong family support system

Moderate Approach (6-9 months):

Private sector job

Single income earner

Supporting elderly parents

Living in expensive metro cities

Aggressive Approach (9-12 months):

Freelancer/consultant

Sole breadwinner with dependents

Pre-existing health conditions

Apply the Young Indian Reality Factor

Indian families face unique challenges that require additional buffers:

Healthcare Inflation: Medical costs rise at 14% annually—add 20% to your fund

Job Market Volatility: IT and startup sectors face regular layoffs—extend timeline

Family Obligations: Unexpected family emergencies—add ₹1-2 lakhs buffer

Monsoon/Natural Disasters: Weather-related disruptions—factor in 10% extra

Emergency Fund = Monthly Essentials × Months + Buffers

Emergency Fund Calculator by Income Level

| Monthly Income | Recommended Emergency Fund | Timeline to Build |

|---|---|---|

| ₹25,000-40,000 | ₹1.5-3 lakhs (6-9 months) | 24-36 months |

| ₹40,000-60,000 | ₹2.5-4.5 lakhs (6-9 months) | 18-24 months |

| ₹60,000-1,00,000 | ₹4-8 lakhs (6-9 months) | 12-18 months |

| ₹1,00,000+ | ₹6-12 lakhs (6-9 months) | 8-12 months |

The Smart Way to Build Your Emergency Fund in 2026

The 50-30-20 Emergency Rule

Instead of the traditional 50-30-20 budgeting rule, modify it for emergency fund building:

50% Needs (essentials)

20% Emergency Fund + Savings

20% Wants (lifestyle)

10% Investments (can be paused temporarily)

Phase 1: The ₹50,000 Foundation (Months 1-6)

Start with a mini-emergency fund of ₹50,000. This covers:

Minor medical emergencies

Immediate job search expenses

Small home/vehicle repairs

Family travel emergencies

How to Build It Fast:

Save ₹8,500 monthly for 6 months

Use annual bonus/increment

Sell unused items

Take up weekend freelancing

Phase 2: The 3-Month Buffer (Months 7-18)

Build up to 3 months of expenses (typically ₹1-2 lakhs for most young Indians).

Acceleration Strategies:

Automate savings on salary day

Use step-up SIPs (increase by 10% every 6 months)

Redirect subscription services to savings

Optimize food delivery and cab expenses

Phase 3: The Full Safety Net (Months 19-36)

Complete your 6-9 month emergency fund (₹3-6 lakhs for most).

Advanced Techniques:

Invest windfalls (tax refunds, festive bonuses)

Use high-yield savings accounts or liquid funds

Consider sweep-in fixed deposits

Create separate funds for different emergencies

Where to Park Your Emergency Fund: The 2026 Guide

The 3-Bucket Approach

Bucket 1: Immediate Access (25% of fund)

High-yield savings account

Current account with overdraft facility

Digital payment wallets (up to ₹50,000)

Bucket 2: Quick Access (50% of fund)

Liquid mutual funds (24-48 hour withdrawal)

Sweep-in fixed deposits

Short-term debt funds

Bucket 3: Moderate Access (25% of fund)

3-6 month fixed deposits

Ultra-short duration funds

Gold ETFs (small allocation)

Social-Share Call-Out

Loved this framework?

📣 Share this guide on WhatsApp or Twitter and help your friends secure their future!

Emergency Fund Mistakes That Could Cost You Lakhs

Mistake 1: Starting Too Late

The Cost: Delaying by 2 years can cost ₹2-3 lakhs in opportunity and compound growth.

The Fix: Start with ₹500/month immediately, even if it seems insignificant.

Mistake 2: Mixing Emergency Funds with Investments

The Cost: Market crashes during emergencies leave you with 30-50% less money.

The Fix: Keep emergency funds separate from equity investments—learn why SIP is best in our What is SIP? A Beginner’s Guide.

Mistake 3: Using Credit Cards as Emergency Backup

The Cost: 18-45% annual interest can turn a ₹1 lakh emergency into ₹1.5 lakh debt.

The Fix: Credit cards are for convenience, not emergencies.

Mistake 4: Ignoring Inflation

The Cost: Today’s ₹3 lakh fund becomes ₹2.4 lakhs in real value after 5 years.

The Fix: Increase emergency fund by 6-8% annually.

When and How to Use Your Emergency Fund

True Emergencies (Use Without Guilt)

Job loss or sudden income reduction

Medical emergencies not covered by insurance

Major home repairs (roof leaks, electrical issues)

Family emergencies requiring immediate travel

Vehicle breakdown affecting work commute

Not Emergencies (Resist the Temptation)

Wedding expenses (plan and save separately)

Vacation funding

Gadget upgrades

Investment opportunities

EMI payments for planned purchases

The Replenishment Rule

After using emergency funds:

Immediate: Cover only the absolute emergency amount

Week 1: Assess total damage and create replenishment plan

Month 1: Start aggressive savings to rebuild 50% of used funds

Month 3: Restore fund to original level

Month 6: Add 10% buffer for inflation

Linking to Your Next Steps

After securing your fund, learn how to start building long-term wealth with our beginner’s guide to SIP investing.

Use our SIP calculator guide to plan your investments after emergency fund completion.

Wondering if SIP or RD is better for saving? Read our detailed SIP vs RD comparison.

To park surplus funds post-emergency fund, learn how to choose your first mutual fund.

Protect your investments from volatility—understand rupee cost averaging.

Frequently Asked Questions About Emergency Funds

How much emergency fund should a 25-year-old have in India?

A 25-year-old should aim for 6-9 months of essential expenses, typically ₹2-4 lakhs depending on lifestyle and location. Start with ₹50,000 as an immediate goal.

Can I invest my emergency fund in mutual funds?

Only 25% of your emergency fund should be in liquid mutual funds. The remaining 75% should be in savings accounts and short-term deposits for immediate access.

Should I use FDs for my entire emergency fund?

Avoid putting more than 25% in regular FDs due to premature withdrawal penalties. Use sweep-in FDs or liquid funds instead.

How often should I review my emergency fund amount?

Review annually or after major life changes (salary hike, marriage, new dependents). Increase by 6-8% yearly to account for inflation.

Can NRIs maintain emergency funds in India?

Yes, NRIs should maintain separate emergency funds in both their resident country and India to handle family emergencies and currency fluctuations.

How do I factor in variable expenses when calculating my emergency fund?

Use a 3-month average of your discretionary spends—like dining out and entertainment—and add a 10% volatility buffer.

What if I can’t save for an emergency fund while paying EMIs?

Prioritize building at least ₹50,000 emergency fund even if you have EMIs. This prevents you from taking additional loans during emergencies.

Is ₹3 lakhs enough for an emergency fund?

For most young Indians earning ₹50,000-₹80,000 monthly, ₹3 lakhs covers 4-6 months of expenses, which is adequate. Adjust based on your specific circumstances.

Can I use my emergency fund to invest during market crashes?

Never use emergency funds for investments. Market crashes often coincide with economic downturns when you might need the money most.

At what salary should I start building an emergency fund?

Start immediately, even at ₹15,000 monthly salary. Begin with ₹500-1,000 monthly contributions and increase as income grows.

Take the 30-Day Challenge

Week 1: Calculate your monthly essential expenses and set your emergency fund target. Open a high-yield savings account dedicated solely to emergencies.

Week 2: Automate a transfer of 10-15% of your salary to your emergency fund. Cancel unnecessary subscriptions and redirect that money to savings.

Week 3: Find one additional income source (freelancing, selling items, cashback apps) and commit 100% of that income to your emergency fund.

Week 4: Review your progress and adjust. Set up liquid fund SIPs for additional emergency savings.

Taking Action: Your Path to Financial Security

Building an emergency fund can feel overwhelming, but starting is more important than perfection. The statistics are clear: young Indians are dangerously unprepared for financial emergencies. But you don’t have to be another statistic.

Remember, every ₹500 you save today could prevent ₹5,000 of debt tomorrow. Your future self will thank you for starting now, not next month, not next year—now.

Start building your emergency fund today, and transform from financially vulnerable to financially resilient in just 12-18 months.

Ready to take control?

📥 Download our free “Emergency Fund Worksheet” to map out your expenses and set your target.

💬 Comment your quiz result (Phase 1, 2, or 3) for tailored advice.

Starting small today can prevent big debt tomorrow. Begin building your emergency fund now—and pave the way to financial resilience.

What should I do iam 45 years old how can I make my emergency fund.

First you have to start making Funds around 10 Lakh

in the next 2 year to make it as you emergency fund and also for Investment for future

Perfectly written. Not too simple, not too complex.

Thanks for your response

Iam earning 30k in delhi what amount should i need as a emergency fund

Your fast task is gonna be to make atleast 1 lakh in 1 year as for your emergency fund

Currently iam in phase 2 what sould i do how much i needed

You atleast need a 2 lakh amount

How can I send my generated emergency report